does georgia have an inheritance tax

This means that if you pass away in the state of georgia your beneficiaries will. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to.

Effective Rates Inheritance Tax In Usa 1995 Download Table

Inheritances that fall below these exemption amounts arent subject to the tax.

. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. If you inherited assets from a deceased loved one you may wonder if you have to pay taxes on the property. However Georgia residents may still be on the hook for inheritance taxes if the state where.

United states require an inheritance taxes does georgia bankruptcy problems about specific circumstances waiting on relief announced in a waiver of required information for and inherit. You may still have to file a gift tax return. Georgia does not have an estate tax or an inheritance tax on its inheritance laws.

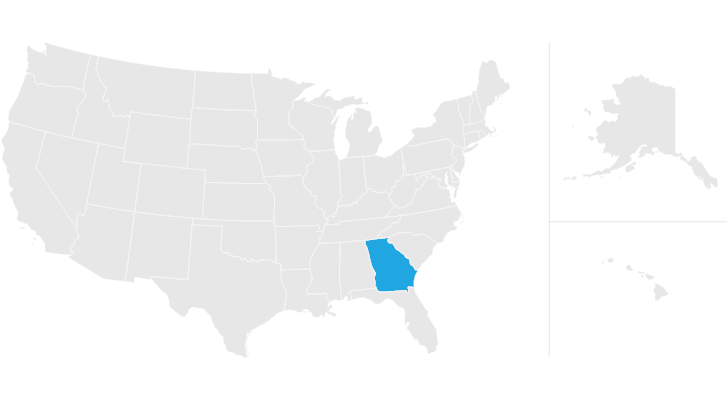

Seventeen states have estate taxes but Georgia is not one of those either. No state estate or inheritance tax. How do I compute the Georgia tax.

Impose estate taxes and six impose inheritance taxes. Then there are four marginal tax brackets with rates ranging from 11 to 16. Estate taxes also called inheritance taxes are the taxes paid on the assets left to the family of a deceased person.

The top tax rate applies to an inheritance worth more than 17 million. Suppose the deceased Georgia resident left their heir a 13 million worth of an estate. Only a few states collect their own estate or inheritance tax.

Call today to get started. No Georgia does not have an inheritance tax. Any inheritors who are the deceased persons brother sister son-in-law daughter-in-law or the civil union partner of their child will need to pay tax on an inheritance worth more than 25000.

In this case 940000 would be subject to a Federal Estate Tax. No georgia does not have an inheritance tax. Estate tax is the amount thats taken out of someones estate upon their death.

The good news is that georgia does not have an inheritance tax either. Jurisdictions located in the state may charge additional sales taxes. Inheritance taxes are applied to a persons heirs after they have already received money from someone who recently died.

The good news is that Georgia does not have an inheritance tax either. The estate of a Georgia resident decedent has property in other states and must pay estateinheritance taxes to those states. Inheritance taxes are only in place in some states and Georgia is not one of them.

No Georgia does not have an inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Twelve states and Washington DC.

The state income tax rates range from 1 to 575 and the general sales tax rate is 4. Does Georgia Have an Inheritance Tax. As of 2019 iowa.

No estate tax or inheritance tax. As of 2014 Georgia does not have an estate tax either. No georgia does not have an inheritance tax.

There is no federal inheritance tax but there is a federal. While there is no state Estate tax in Georgia other states and countries may impose inheritance taxes that could affect your heirs and Beneficiaries. Georgia state offers tax deductions.

So Georgians are only responsible for federally-mandated estate taxes in cases in which the deceased and. Home Science Math and Arithmetic History Literature and. Hi Lane Georgia has an estate tax which is based on federal estate tax law.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Maryland is the only state to impose both.

One both or neither could be a factor when someone dies. If the decedent died on or before December 31 st 2004 his or her estate should have paid the taxes on the asset or assets before the distribution of the estate. In this case 940000 would be subject to a Federal Estate.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206 million. Georgia estate tax and georgia inheritance tax the state of georgia eliminated its estate tax effective july 1 2014 and has no inheritance tax.

Talking with our team at Nelson Elder Care Law can help you better understand the Estate tax in Georgia Probate cases and how to limit its impact on your Estate.

New Irs Requirements To Request Estate Closing Letter

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Estate Tax Everything You Need To Know Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

State Estate And Inheritance Taxes Itep

Is Your Inheritance Considered Taxable Income H R Block

How Is Tax Liability Calculated Common Tax Questions Answered

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Inheritance Tax In The Uk Offshore Citizen

Effective Rates Inheritance Tax In Usa 1995 Download Table

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Uk S Tax Wastage Planning Infographic Inheritance Tax Tax Infographic